| Not logged in : Login |

About: Luxottica Vertically Integrated Business Model In A Nutshell Goto Sponge NotDistinct Permalink

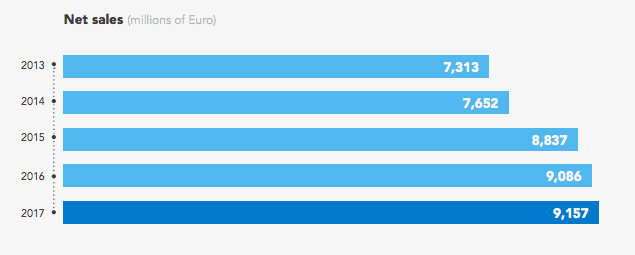

With €9 billion in net sales and net income for over a billion in 2017, Luxottica had about 85,000 employees in 2018. A vertically integrated organization, founded in 1961, when Leonardo Del Vecchio, an Italian entrepreneur, incorporated it. Luxottica grew from a small shop that produced components, to a prominent company in the eyewear industry. , Leonardo Del Vecchio is listed as the 34th wealthiest person on earth, with a personal wealth of over $23 billion. Luxottica origin story It all started in 1961, when Leonardo Del Vecchio, an Italian entrepreneur, incorporated Luxottica. Luxottica didn't begin with great ambitions. It was a small shop that produced components and semi-finished products for the optical industry. Yet by the 1970s Luxottica had become an integrated manufacturer able to produce the finished pair of glasses. The transition between contract manufacturer to a producer can be traced to 1971 when Luxottica first collection was presented in Milan. It was starting in 1974 that the company started a strategy of vertical integration. In short, Luxottica has begun to control the whole supply chain. First, by distributing frames directly to retailers. Then, in the 1980s Luxottica started the international expansion by acquiring independent distributors. As eyewear became more and more, a fashion object brought Luxottica to acquire Sferoflex, which allowed the company to improve the design of its products, thus enhanced its brand. The growth of Luxottica as a brand has walked hand in hand with its commercial expansion. In fact, in 1988 Luxottica entered in a licensing agreement with Giorgio Armani. It then continued those licensing agreements with famous luxury brands, like Bulgari, Chanel, Prada and many others. Luxottica also kept acquiring other brands, comprising Oakey (the California-based eyewear company), which of the time of the acquisition had over 160 stores. To strengthen its vertically integrated business, Luxottica also acquired several chains Sunglass Hut (2001), OPSM Group (2003), and Cole National (2004). In 2016, Luxottica completed the acquisition of Salmoiraghi & Viganò, in which it has held a minority stake since 2012. At the time of this writing, Leonardo Del Vecchio is listed as the 34th wealthiest person on earth, after Michael Dell, with a personal wealth of over $23 billion. Luxottica business model With €9 billion in net sales and net income for over a billion, Luxottica had about 85,000 employees in 2018. A vertically integrated organization with a wide wholesale organization and a retail network located primarily in four regions: North America, Latin America, Asia-Pacific and Western Europe. The vertical integration of Luxottica hasn't happened overnight. Instead, it represented the fulfilling of a vision from its founder, Leonardo Del Vecchio. As he started to produce entire frames, rather than just components. Thus, vertical integration of manufacturing was gradually accompanied by the expansion of distribution, starting with wholesale and later on, with retail and a critical presence in the high value-added business of lens finishing. One of the critical aspects of vertical integration is the ability of the company executing it to control the quality of each step of the supply chain. Thus, have total control over the final offering, pricing, and product development. Those high standards is what Luxottica calls “Made in Luxottica” standard. One of the issues of a fragmented supply chain is the inability to truly understand customers, especially if the company is not controlling the retail side of its distribution. On the other hand, if a company is too focused on the retail side, it might be tough to lower the cost of its materials, while keeping its quality pretty high. Instead, a vertically integrated business model allows keeping control of all the aspects, from product development to retail. This, in turn, also makes Luxottica aware of all its elements, by forming a 360 degrees view of its business. Luxottica operations the Group has two primary operating segments: • Wholesale: with the manufacturing and wholesale distribution; • Retail: mainly focused on distribution to customers In 2017, Retail represented 62% of Luxottica revenues, while Wholesale represented 38% of net sales. If we look at the geographical areas, the central regions are: North America, which represented 57% of Luxottica revenues in 2017 Europe represented 21% of Luxottica revenues in 2017 Asia - Pacific represented 13% of the revenues in 2017 Latin America represented 7% of the revenues in 2017 Luxottica financials In 2017, Luxottica generated more than €9 billion in revenues, compared to €7.3 billion in 2013. The operating income has also improved from over a billion euros in 2013, to €1.3 billion in 2017. The net income almost doubled since 2013. From 545 million euros to over a billion in 2017. Luxottica manufacturing and distribution Product design, development, and manufacturing for frames take place in several facilities: six production facilities in Italy, three factories in China, one in Brazil and one facility in the United States (mainly devoted to sports and performance eyewear) The distribution wholesale distribution covers more than 150 countries with about 50 commercial subsidiaries with direct operations in key markets With its manufacturing and distribution strategy Luxottica has managed to dominate several regions: Optical retail business in North America with its LensCrafters and Pearle Vision brands, Australia and New Zealand with the OPSM and Laubman & Pank brands, China with the LensCrafters brand, Italy with the Salmoiraghi & Viganò brand Latin America with the GMO and Óticas Carol brands Luxottica has also built over the years an e-commerce platform that comprises Ray-Ban.com, Oakley.com, Persol.com, Vogue-Eyewear.com, SunglassHut.com, and Glasses.com How Does Twitter Make Money? Twitter Business Model In A Nutshell How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained How Amazon Makes Money: Amazon Business Model in a Nutshell How Does Netflix Make Money? Netflix Business Model Explained How Does PayPal Make Money? The PayPal Mafia Business Model Explained How Does WhatsApp Make Money? WhatsApp Business Model Explained The Power of Google Business Model in a Nutshell How Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

| Attributes | Values |

|---|---|

| type | |

| label |

|

| label |

|

| sameAs | |

| Description |

|

| depiction | |

| name |

|

| url | |

| legalName |

|

| http://www.w3.org/2007/ont/link#uri | |

| is Relation of |

Alternative Linked Data Documents: PivotViewer | iSPARQL | ODE Content Formats:

![[cxml]](/fct/images/cxml_doc.png)

![[csv]](/fct/images/csv_doc.png) RDF

RDF

![[text]](/fct/images/ntriples_doc.png)

![[turtle]](/fct/images/n3turtle_doc.png)

![[ld+json]](/fct/images/jsonld_doc.png)

![[rdf+json]](/fct/images/json_doc.png)

![[rdf+xml]](/fct/images/xml_doc.png) ODATA

ODATA

![[atom+xml]](/fct/images/atom_doc.png)

![[odata+json]](/fct/images/json_doc.png) Microdata

Microdata

![[microdata+json]](/fct/images/json_doc.png)

![[html]](/fct/images/html_doc.png) About

About

![[RDF Data]](/fct/images/sw-rdf-blue.png)

OpenLink Virtuoso version 08.03.3330 as of Mar 11 2024, on Linux (x86_64-generic-linux-glibc25), Single-Server Edition (7 GB total memory, 6 GB memory in use)

Data on this page belongs to its respective rights holders.

Virtuoso Faceted Browser Copyright © 2009-2024 OpenLink Software