| Not logged in : Login |

About: How Amazon Makes Money: Amazon Business Model in a Nutshell Goto Sponge NotDistinct Permalink

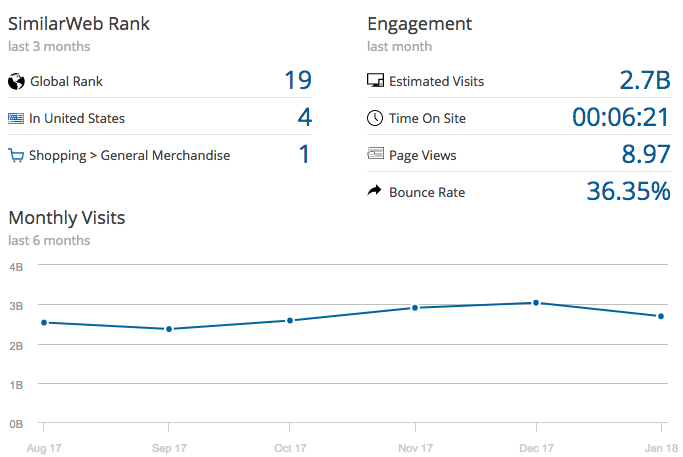

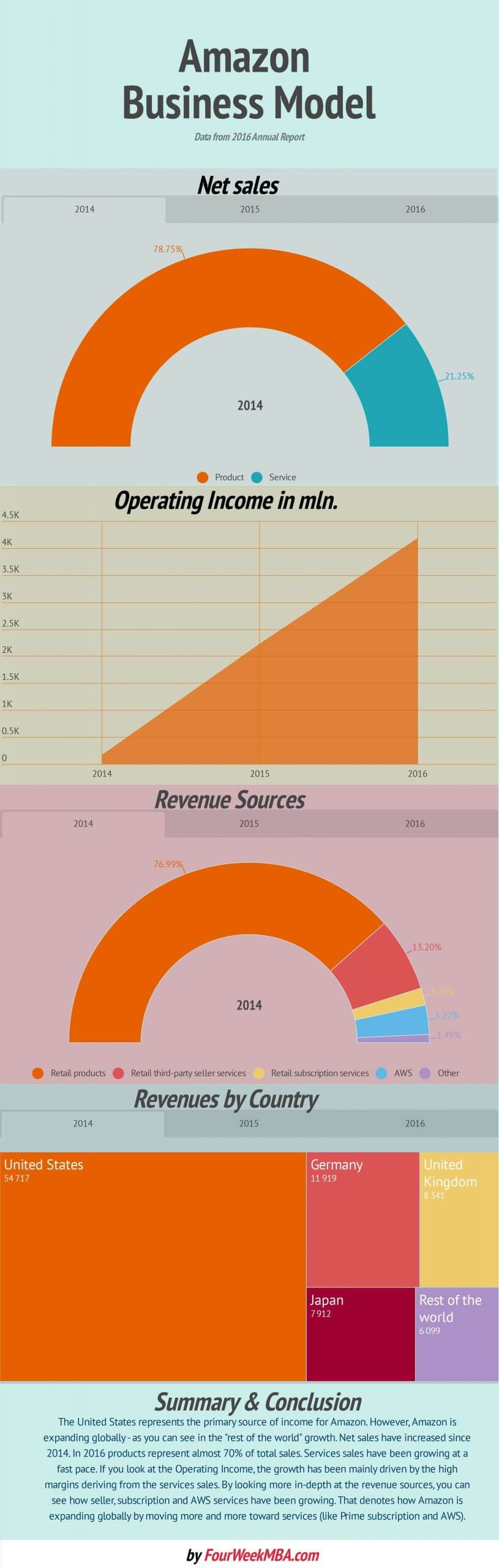

Amazon is the largest marketplace on earth. Even though the United States represented the primary source of income for Amazon. It is expanding globally. Indeed, net sales have increased since 2014. In 2016 products represented almost 70% of total sales. Services sales have been growing at a fast pace. In terms of Operating Income, the growth has been mainly driven by the high margins deriving from the services sales. By looking more in-depth at the revenue sources, subscription and AWS services have been growing. That denotes how Amazon is expanding globally by moving more and more toward services (like Prime subscription and AWS). What is a business model? A business model is a crucial component of any company that wants to thrive in the long-run. In fact, many times the difference between a successful and a failing business - besides the product or service offered - is how value gets unlocked. The business model is the main driver of value. In fact, the business model can determine the difference between a monkey and a unicorn. In start-up lingo, a unicorn is a company valued more than a billion dollars. Whatever you want to call that, any start-up wildest dream is to scale up fast and get there! There is a simple reason for that. If you get to a billion dollar valuation, the chances of survival will improve exponentially. Of course, that is true in the context of North American venture capital market. Elsewhere numbers might be entirely different. One key factor in becoming a unicorn as you can imagine is about finding the right business model. According to visualcapitalist.com, seven business models have higher odds to get into the unicorn circle: 1. Commission 2. Asset Sale 3. Subscription plans 4. Advertising 5. Usage Fees 6. Licensing 7. Rent/Lease Source: visualcapitalist.com According to the same analysis, 87% of unicorns' products are software, followed by hardware (7%). For how much we love to believe that things can be easily classified. Organizations, like Amazon, have complex business models that are hybrid. Thus, rather than rely on a single type of model, they are dependent on the mixture of those models. The way those models interact is quite subtle, yet that is what really creates, unlocks and generates value in the long-term. To truly understand the business model of Amazon, we can start with Jeff Bezos vision. Then move to its revenues, but then we have to dig a bit deeper to find out a few interesting facts. Amazon according to Jeff Bezos' vision At times a great place to start to understand the business models of a startup it isn't necessarily its financials but rather how the founder sees its baby. In fact, for any founder a la Jeff Bezos its company has been nurtured just like a baby. Of course, the founders' vision of their company can also be biased. In which case the perception of the company according to its founder and how the public perceives it might have a wide gap. However, it is a useful exercise to look at the shareholder's letters if you want to understand the past, present, and future of any company. From Jeff Bezos' 2016 letter to shareholders, it seems clear that he has one metric in mind "Being on Day One!" For Jeff Bezos, that means to avoid decline or extreme slow motion and push for more each day. As he put it: Day 2 is stasis. Followed by irrelevance. Followed by excruciating, painful decline. Followed by death. And that is why it is always Day 1. He has four main metrics to assess whether his company is on Day One, or is falling toward Day Two: 1. Customer obsession, You can be competitor focused, you can be product focused, you can be technology focused, you can be business model focused, and there are more. But in my view, obsessive customer focus is by far the most protective of Day 1 vitality. 2. A skeptical view of proxies, As companies get larger and more complex, there’s a tendency to manage to proxies. What does that mean? A common example is process as proxy. Good process serves you so you can serve customers. But if you’re not watchful, the process can become the thing. This can happen very easily in large organizations... ...The process is not the thing. It’s always worth asking, do we own the process or does the process own us? 3 The eager adoption of external trends, The outside world can push you into Day 2 if you won’t or can’t embrace powerful trends quickly. If you fight them, you’re probably fighting the future. Embrace them and you have a tailwind... ...We’re in the middle of an obvious one right now: machine learning and artificial intelligence. 4. High-velocity decision making. Day 2 companies make high-quality decisions, but they make high-quality decisions slowly. To keep the energy and dynamism of Day 1, you have to somehow make high-quality, high-velocity decisions... ...First, never use a one-size-fits-all decision-making process... ...Second, most decisions should probably be made with somewhere around 70% of the information you wish you had... Third, use the phrase “disagree and commit.” ... “Look, I know we disagree on this but will you gamble with me on it? Disagree and commit?” Putting it all together Jeff Bezos offers a portrait of Amazon which is useful to understand its business model deeply. First, it all starts with Day One. Which, for me is a way for Amazon to keep a "start-up mindset" also if it has become a large organization. It means focusing on customers, therefore, experimenting with new products lines, services or anything that might become "delightful" to the public. In fact, once Amazon does identify strong trends, rather than fight them it embraces them. One example is how nowadays Amazon is using AI and machine learning as the main propellers for its business growth. In other words, practically speaking this makes Amazon fluid. Thus, the Amazon of tomorrow might have a different face - but the same soal - compared to the Amazon of today. How does Amazon work? Amazon is a giant marketplace where each day billions of people find anything from the latest best selling book to things like Nicolas Cage pillowcase. According to the Similar Web estimates each day, only in the US Amazon has over 2.7 billion visits. On average those people spend more than six minutes on the site and look at almost nine pages purchasing what they're looking for. That makes Amazon the fourth most popular site in the US. The Amazon business model revolves around four main players: Consumers As Amazon states in its annual report: We serve consumers through our retail websites and focus on selection, price, and convenience. We design our websites to enable hundreds of millions of unique products to be sold by us and by third parties across dozens of product categories. Customers access our websites directly and through our mobile websites and apps. We also manufacture and sell electronic devices, including Kindle e-readers, Fire tablets, Fire TVs, and Echo, and we develop and produce media content. We strive to offer our customers the lowest prices possible through low everyday product pricing and shipping offers, and to improve our operating efficiencies so that we can continue to lower prices for our customers. We also provide easy-to-use functionality, fast and reliable fulfillment, and timely customer service. In addition, we offer Amazon Prime, an annual membership program that includes unlimited free shipping on tens of millions of items, access to unlimited instant streaming of thousands of movies and TV episodes, and other benefits. Sellers We offer programs that enable sellers to grow their businesses, sell their products on our websites and their own branded websites, and fulfill orders through us. We are not the seller of record in these transactions. We earn fixed fees, a percentage of sales, per-unit activity fees, interest, or some combination thereof, for our seller programs. Developers and enterprises We serve developers and enterprises of all sizes, including start-ups, government agencies, and academic institutions, through our AWS segment, which offers a broad set of global compute, storage, database, and other service offerings. Content creators We serve authors and independent publishers with Kindle Direct Publishing, an online service that lets independent authors and publishers choose a 70% royalty option and make their books available in the Kindle Store, along with Amazon’s own publishing arm, Amazon Publishing. We also offer programs that allow authors, musicians, filmmakers, app developers, and others to publish and sell content. An effective business model to work properly has to involve and generate value for several stakeholders. That applies to the Amazon business model as well. In fact, when I get into the Amazon marketplace as a consumer I can find anything across dozens of products categories. Among those, I can also buy Amazon products (like Kindle, and Echo), or subscribe to Prime (to get faster delivery and even access to an on-demand library of contents). Also, thanks to Amazon seller program the company earns fixed fees, a percentage of sales, per-unit activity fees, interest, or some combination of those based on the transactions generated by the marketplace; Although AWS is a platform of its own. Nonetheless, it has a strategic role in Amazon. Last but not least, the KDP platform allows thousands of independent authors to publish their e-books and info-products. According to the plan in which the independent author enrolls into Amazon will earn anywhere from 30-70% of royalty fees from the sales. Like all the other tech giants Amazon could create such a robust business model that it now works as the main engine for the dominance of the company in the next decade; As technology becomes more and more competitive business models lose effectiveness. However, a business model well-designed can make a company capture value for a long time! How does Amazon make money? It's time to dive into the numbers to understand how the company works. When trying to understand a business model, the revenues are a good starting point. But it's also important to look at other financial metrics to deeply understand what's the real cash cow. In fact, it's easy to be fooled to believe a company falls into a specific business model. However, numbers don't lie. Where does Amazon stand? According to the infographic, you can see that Amazon makes most of its revenues from the sales of products. However, those products sales also have high costs. Thus, the margins Amazon makes on them is thin. Instead, if we look at the operating income, you can see how this is fueled by the services, which comprise seller services, AWS, and subscriptions services. In other words, by looking at the revenue, you might be fooled to think that Amazon is in the product business, just like Apple, yet there is a slight difference between the two companies! Amazon vs. Apple Like many things in business, so revenue generation seems to follow a power law. You try quite many things, but you end up with one reliable and sustainable source of income after all. Sometimes the differences in business models are subtle. Take Apple and Amazon. As they generate most of their revenues from "products" one might think they have the same business model. However, with a more in-depth look your realize their model is entirely different. In fact, while Apple sells its iPhone at a high margin, Amazon sells its products at a thin margin (in fact, cost of sales for Amazon is almost as high as the revenue generated by its products). In short, Amazon seems to use its products to ramp up its services revenues, which seems to be the real cash cow. However, if you look at revenues alone, you might be fooled to believe Amazon is in the "product" business. Summary and Conclusions Amazon is a tech giant. When it started back in the 1990s, it began as an online bookstore. Today Amazon is the store that sells anything imaginable. As its founder, Jeff Bezos has specified Amazon is a customer-centric company. However, it is clear that what made and makes Amazon so compelling is the business model created that it generates value for several players. Consumers find products at a lower price and get it way faster. Sellers can find new market opportunities or decide not to carry any inventory. In fact, Amazon has its own fulfillment center that manages the inventories for sellers. Thus, that makes very easy for anyone willing to start an online business to start up with meager cost. Developers and enterprises can rely on AWS cloud services. Last but not least content creators can effectively monetize their info-products through programs like KDP. Even though Amazon makes almost 70% of its revenues through products sales. It is also true that those revenues carry a high cost of sales. Therefore, margins are thin. Instead, the real cash cow for Amazon seems to be the service part, which comprises AWS, seller services, and subscriptions services. These segments have been growing in the last year, and I argue they will continue to grow in the future. Amazon shows us a valuable lesson. For how much we like to categorize things under fixed, immutable categories and definitions. Often, a company to become a multi-billion enterprise has to create a hybrid business model that takes advantage of several models at once. Take Google, it started as a search engine with an advertising business model, yet it is now diversifying in other areas. In fact, even though 86% of Google revenues still come from advertising in 2017, Google makes money in many other ways. From this kind of business, the model value gets unlocked for several players. When that happens the sky is the limit! Handpicked related content: What Is a Business Model? 30 Successful Types of Business Models You Need to Know What Is a Business Model Canvas? Business Model Canvas Explained What Is the Receivables Turnover Ratio? How Amazon Receivables Management Helps Its Explosive Growth Amazon Case Study: Why from Product to Subscription You Need to “Swallow the Fish” What Is Cash Conversion Cycle? Amazon Cash Machine Business Model Explained How Does Twitter Make Money? Twitter Business Model In A Nutshell How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained How Does Netflix Make Money? Netflix Business Model Explained How Does PayPal Make Money? The PayPal Mafia Business Model Explained How Does WhatsApp Make Money? WhatsApp Business Model Explained How Does Google Make Money? It’s Not Just Advertising! How Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

| Attributes | Values |

|---|---|

| type | |

| label |

|

| label |

|

| sameAs | |

| Description |

|

| depiction | |

| name |

|

| url | |

| founder | |

| http://www.w3.org/2007/ont/link#uri | |

| is References of |

Alternative Linked Data Documents: PivotViewer | iSPARQL | ODE Content Formats:

![[cxml]](/fct/images/cxml_doc.png)

![[csv]](/fct/images/csv_doc.png) RDF

RDF

![[text]](/fct/images/ntriples_doc.png)

![[turtle]](/fct/images/n3turtle_doc.png)

![[ld+json]](/fct/images/jsonld_doc.png)

![[rdf+json]](/fct/images/json_doc.png)

![[rdf+xml]](/fct/images/xml_doc.png) ODATA

ODATA

![[atom+xml]](/fct/images/atom_doc.png)

![[odata+json]](/fct/images/json_doc.png) Microdata

Microdata

![[microdata+json]](/fct/images/json_doc.png)

![[html]](/fct/images/html_doc.png) About

About

![[RDF Data]](/fct/images/sw-rdf-blue.png)

OpenLink Virtuoso version 08.03.3330 as of Mar 11 2024, on Linux (x86_64-generic-linux-glibc25), Single-Server Edition (7 GB total memory, 5 GB memory in use)

Data on this page belongs to its respective rights holders.

Virtuoso Faceted Browser Copyright © 2009-2024 OpenLink Software