| Not logged in : Login |

About: How Does Grubhub Make Money? Grubhub Business Model In A Nutshell Goto Sponge NotDistinct Permalink

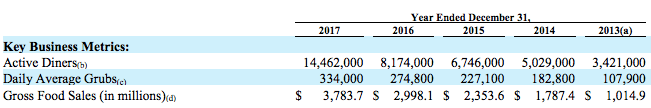

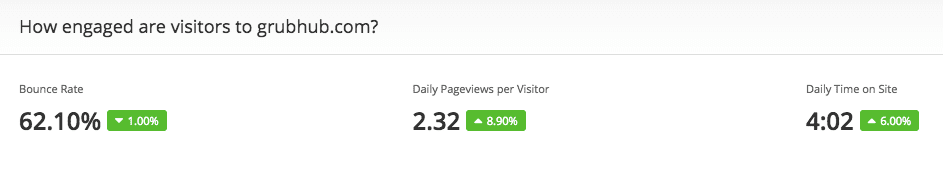

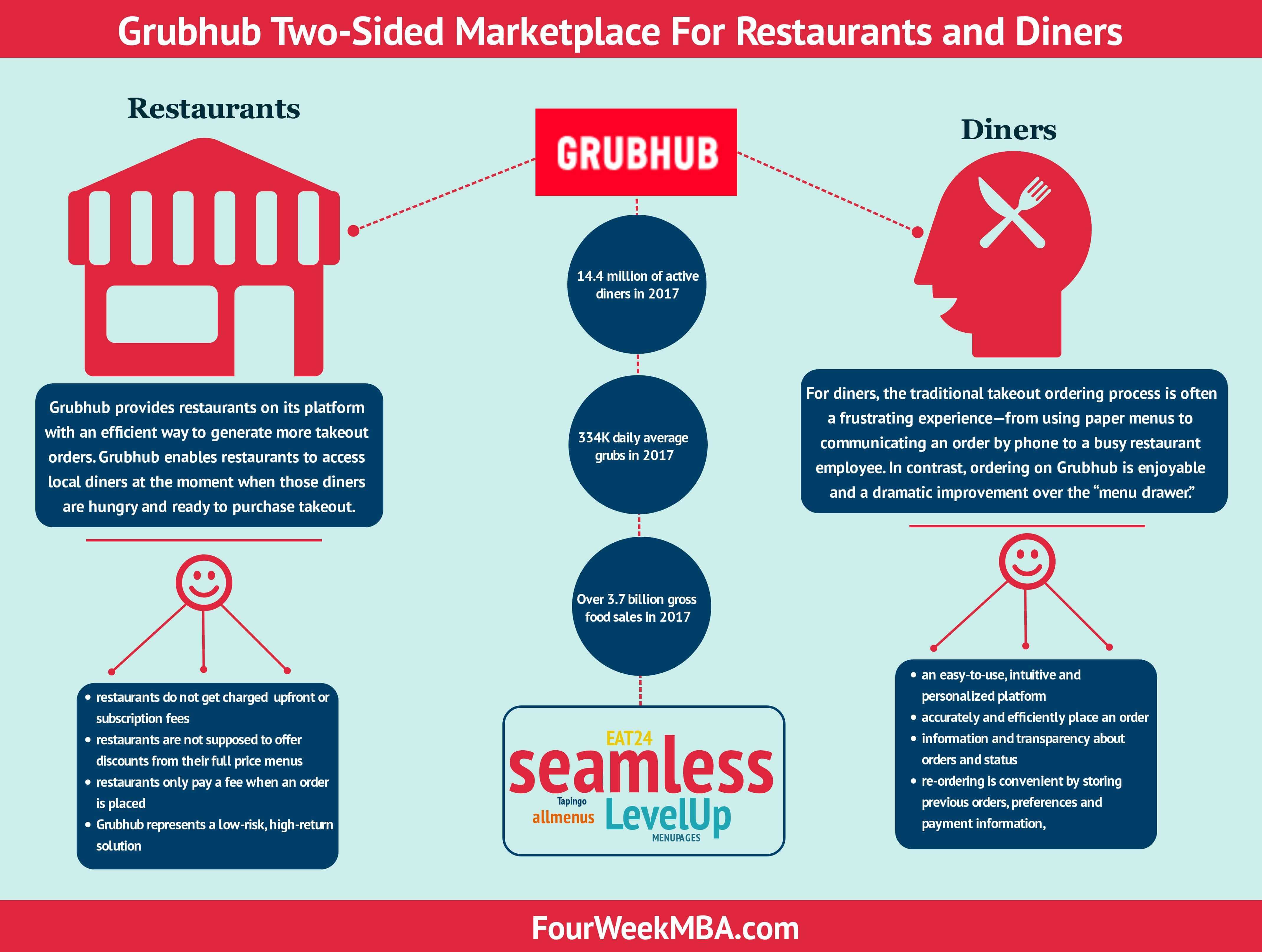

Grubhub is an online and mobile platform for restaurant pick-up and delivery orders. In 2018 the company connected 95,000 takeout restaurants in over 1,700 U.S. cities and London. The Grubhub business model comprises a portfolio of brands like Seamless, LevelUp, Eat24, AllMenus, MenuPages, and Tapingo. The company makes money primarily by charging restaurants a pre-order commission, and it generates revenues when diners place an order on its platform. Also, it charges restaurants that use Grubhub delivery services and when diners pay for those services. Grubhub portfolio of brands Source: Grubhub official website At the time of this writing, Grubhub comprises a portfolio of brands that includes Grubhub, Seamless, LevelUp, Eat24, AllMenus, MenuPages and Tapingo. The company was founded in 2004, and it merged with Seamless - founded in 1999 - in 2013. Grubhub has been able to grow substantially following the merger with Seamless and aggressive acquisitions of other brands. Who are Grubhub key partners? Grubhub two-sided marketplace explained As a two-sided platform, Grubhub offers value for two key partners: restaurants and diners The value and ability to grow its business highly depend on Grubhub ability to keep offering a compelling value proposition for those two key partners. What is Grubhub value proposition? The value proposition changes according to the key partner Grubhub is able to reach with its services. Indeed, the Company has a powerful two-sided network that creates value for both restaurants and diners. Therefore, it is critical to distinguish between the value proposition offered to those two partners. The value proposition for restaurants Grubhub has been able to deliver a unique value proposition for restaurants, as it generates higher margin takeout orders at full menu prices. Indeed, for restaurants, the takeout is a way to grow their business without adding seating capacity or staff. Also, being able to promote takeout is expensive, inefficient and its success can't be tracked. Thus, Grubhub is offering a risk-free service to restaurants to grow their business. In contrast, restaurants can track orders on the platform quite efficiently, by connecting restaurants with local diners with the least effort and best match. This is a compelling value proposition for restaurants. But there is even more to it. Why is the value proposition so compelling for restaurants? There are also three key incentives for restaurants to be part of the Grubhub network: Grubhub does not charge the restaurants any upfront or subscription fees the platform does not require restaurants to apply any discount on their menu (in contrast to other platforms) restaurants only pay Grubhun when the orders from the diner are generated Therefore, Grubhub has packaged a low-risk, high-return solution which is highly efficient, trackable and it carries no upfront cost, neither a subscription fee. The value proposition for diners Diners get what Grubhub defines a “direct line” into the kitchen, avoiding inefficiencies, or frustrations associated with paper menus and phone orders. When Grubhub designed the value proposition for diners, it did so by keeping in mind that the traditional takeout ordering process is often frustrating, while Grubhub has designed its platform to make the user experience as frictionless and rewarding as possible. Therefore, Grubhub value proposition for diners can be summarized in a few key bullet points: an easy-to-use, intuitive and personalized platform that connects diners with local restaurants it makes the - usually bad takeout experience - accurate, efficient and frictionless Grubhub also provides diners with information and transparency about their orders its algorithms make re-ordering convenient by storing previous orders, preferences and payment information, This, in turn, help diners shop more frequently, and restaurants monetize more from continued and repeated business. How does Grubhub make money? Grubhub business model is based on charging restaurants a per-order commission that is primarily percentage-based. In some markets, Grubhub provides delivery services to restaurants on its platform. The Company also generates revenues when diners place an order on its platform. Restaurants can choose their level of commission rate, at or above the base rate. A higher commission rate allows the restaurants to have a higher exposure to diners on the platform. Also, restaurants use Grubhub delivery services pay an additional commission. Fees are also charged to the diners for delivery services it provides. Grubhub usually remits net proceeds to the restaurants on at least a monthly basis. Grubhub key business metrics Any business measures its financial success via a set of metrics that define it. For Grubhub those financial metrics are: Active diners Daily average grubs Gross food sales Source: Grubhub annual report for 2017 active diners are the number of unique diner accounts from which an order has been placed in the past twelve months through the platform daily average grubs are the number of revenue generating orders placed on Grubhub platform divided by the number of days for a given period gross food sales are the total value of food, beverages, taxes, prepaid gratuities, and any diner-paid delivery fees processed through Grubhub platform Grubhub has experienced consistent growth of its key metrics primarily due to increased product and brand awareness by diners: driven by marketing efforts and word-of-mouth referrals better restaurant choices for diners in our markets technology and product improvements acquisitions of other brands A glance at Grubhub growth drivers The company has been able to grow consistently over the years thanks to marketing activities, acquisition, improved platform via its technologies. We'll look more in detail to its marketing and acquisition activities. Marketing campaigns Source: Grubhub annual report for 2017 Grubhub spent over 20% of its revenues in sales and marketing expenses in 2017. Those comprised primarily: advertising expenses including search engine marketing, television, online display, media and other programs salaries, commissions, benefits, stock-based compensation expense, and bonuses payments to contractors and facilities costs The company has been investing in massive resources in digital marketing campaigns. Indeed, if we look at its primary web metrics: According to SimilarWeb Grubhub is the fourth most popular site in the US for restaurants and delivery, in the food and drink category with over sixteen million visitors each month. Also, according to Alexa, the platform has quite good engagement metrics which show a good user experience. If we look at the marketing mix according to Similar Web: Direct and search represent the most important channels. Direct traffic shows us a few critical elements: Grubhub strong brand its ability to reach diners with other channels then search engines Similar Sites according to Alexa comprise other platforms: Of those platforms, seamless.com and eat24.com are part of the Grubhub brand portfolio. Expansion via acquisitions The company invested massively in acquisition campaigns that gave it a strong portfolio of various brands: In 2015, Grubhub acquired assets of DiningIn.com, the membership units of Restaurants on the Run (“Restaurants on the Run”) and membership units of Mealport USA, LLC (“Delivered Dish”) On May 2016, the Company acquired KMLEE Investments Inc. and LABite.com, Inc. (collectively, “LABite”) On October 2017, Grubhub acquired eat24, llC (“eat24”), a wholly owned subsidiary of yelp inc. On August 2017, Grubhub acquired a&D Network Solutions, inc. and Dashed, inc. (collectively, “Foodler”) On September 2018, Grubhub acquired SCVNGR, inc. d/b/a levelUp (“levelUp”) November 2018, Grubhub acquired Tapingo, a leading platform for campus food ordering Understand Grubhub valuation via four main variables Source: Grubhub annual report for 2017 When we look at the valuation of Grubhub it is interesting to notice how the company valuation method takes into account four main variables: restaurant relationships diner acquisition developed technology trademark Grubhub future challenges Some of the challenges that Grubhub has to take into account which might impact its business comprise its ability to: attract and retain restaurants in a cost effective manner maintain, protect and enhance its brand strengthen the takeout marketplace generate positive cash flow and to achieve and sustain profitability keep pace with technology changes in the takeout industry; Who owns Grubhub? Source: Grubhub proxy statement for 2018 The main institutional investors that have an equity stake higher than 5% as of 2018 are Caledonia, Baillie Gifford & Co., The Vanguard Group, T. Rowe Price Associates, BlackRock, Carmignac Gestion, and PAR Investment Partners. Tools and resources for your business: What Is a Business Model? 30 Successful Types of Business Models You Need to Know What Is a Business Model Canvas? Business Model Canvas Explained Marketing vs. Sales: How to Use Sales Processes to Grow Your Business Handpicked popular case studies from the site: The Power of Google Business Model in a Nutshell How Does Google Make Money? It’s Not Just Advertising! How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained How Amazon Makes Money: Amazon Business Model in a Nutshell How Does Netflix Make Money? Netflix Business Model Explained How Does Spotify Make Money? Spotify Business Model In A Nutshell The Trillion Dollar Company: Apple Business Model In A Nutshell DuckDuckGo: The [Former] Solopreneur That Is Beating Google at Its Game

| Attributes | Values |

|---|---|

| type | |

| label |

|

| label |

|

| sameAs | |

| Relation | |

| Description |

|

| depiction | |

| name |

|

| url | |

| legalName |

|

| http://www.w3.org/2007/ont/link#uri |

Alternative Linked Data Documents: PivotViewer | iSPARQL | ODE Content Formats:

![[cxml]](/fct/images/cxml_doc.png)

![[csv]](/fct/images/csv_doc.png) RDF

RDF

![[text]](/fct/images/ntriples_doc.png)

![[turtle]](/fct/images/n3turtle_doc.png)

![[ld+json]](/fct/images/jsonld_doc.png)

![[rdf+json]](/fct/images/json_doc.png)

![[rdf+xml]](/fct/images/xml_doc.png) ODATA

ODATA

![[atom+xml]](/fct/images/atom_doc.png)

![[odata+json]](/fct/images/json_doc.png) Microdata

Microdata

![[microdata+json]](/fct/images/json_doc.png)

![[html]](/fct/images/html_doc.png) About

About

![[RDF Data]](/fct/images/sw-rdf-blue.png)

OpenLink Virtuoso version 08.03.3330 as of Mar 11 2024, on Linux (x86_64-generic-linux-glibc25), Single-Server Edition (7 GB total memory, 6 GB memory in use)

Data on this page belongs to its respective rights holders.

Virtuoso Faceted Browser Copyright © 2009-2024 OpenLink Software